Date: 28th March 2024.

The US Dollar Strengthens As Economists Believe The ECB Will Struggle To “Hold”.

* Early this morning, the Fed Governor advised “there is no rush to cut rates” and “the data within the upcoming months” will be vital.

* The US Dollar Index rises to a 1-month high. The value of the USD will largely be based on today’s data on economic growth, consumer sentiment and pending home sales.

* Dollar and index traders are closely monitoring tomorrow’s Core PCE Price Index which analysts expect will read 0.3%. A higher inflation reading can potentially pressure stocks and support the Dollar.

* Strong declines in NVIDIA and Netflix stocks pressured the NASDAQ on Wednesday. Though, buyers entered late in the session to boost the overall price.

EURUSD

The latest comments from members of the Federal Reserve are supporting the US Dollar. The forward guidance between members of the Federal Reserve is mainly not aligned. The Chairman advises the Fed does not need much more proof for the regulator to feel comfortable reducing rates. Whereas the Fed Governor, Mr Waller, advises there is no rush, and he wants to see a few months of data before determining the next move. Therefore, the upcoming inflation and employment data will remain vital and could even push back rate hikes further. According to economists, the Federal Reserve will cut the interest rate on 3 occasions this year, but the timing of the first cut is less certain and may change depending on upcoming data.

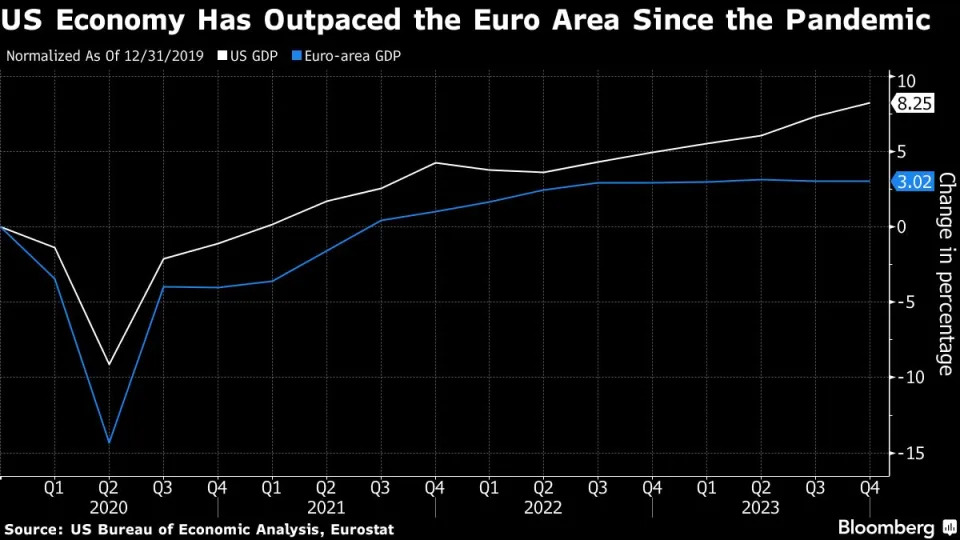

A positive factor for traders is that EURUSD exchange is not witnessing conflicting currencies. The US Dollar is trading 0.12% higher while the Euro is declining against most currencies. The Euro is trading 0.06% lower against the Pound and the Canadian Dollar and 0.16% lower against the Japanese Yen. Yesterday, the head of the Bank of Italy, Mr Cipollone, said that the authorities were confident that inflation would return to the target of 2.0% by mid–2025. He also supports the lower of interest rate and will use this as a basis for adjusting monetary policy. The Euro is generally under pressure as investors believe the European Central Bank will struggle to avoid cuts if the Fed decide to delay their adjustments.

The US Dollar will be influenced by four major economic data releases. The US Final GDP, Weekly Unemployment Claims, Pending Home Sales and Consumer Sentiment Index. If these read higher than expectations with the weekly unemployment claims dropping, the US Dollar is likely to witness further support. However, investors should note the main release will be tomorrow’s Core PCE Price Index. Traders are expecting no major news for Europe and volatility levels may fall tomorrow as European markets are closed for Easter.

Technical analysis currently points towards a continued downward trend. The price is trading below the neutral on the RSI and below the 75-Bar EMA. However, investors should note this will also be dependent on upcoming US data.

USA100

The price of the USA100 was under pressure throughout the whole US session but was saved by an increased volume of buyers late in the session. However, a positive point is the components held onto their value. Even though the index fell in value, only 28% of the components declined. Investors will now turn their attention towards tomorrow’s PCE Price Index and the upcoming earnings season which will start in mid-April.

The price is now trading slightly above the Moving Averages but slightly below the 50.00 on the RSI. Therefore, technical analysis remains at the “neutral” level and continues to indicate a larger price range. If today’s economic data is positive the stock market can witness confidence and support as this continues to indicate a soft landing. Though, if the data is too strong, it could also trigger a hawkish Fed which is known to be negative for the USA100.

Always trade with strict risk management. Your capital is the single most important aspect of your trading business.

Please note that times displayed based on local time zone and are from time of writing this report.

Click HERE to access the full HFM Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE!

Click HERE to READ more Market news.

Michalis Efthymiou

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

中国外汇论坛

外汇社区的地方

主題:

主題:

回覆時引用此篇文章

回覆時引用此篇文章